|

Grain prices remained lifeless over the past week. Prices are respecting the long term chart support they are sitting at, which unfortunately is near 10 year lows.

Fundamentals aren’t helping to turn this bear market around. Demand has been lost due to Covid 19, and world carry outs are large by historical standards. Now it will come down to US growing conditions.

As of May 17, 80 percent of US corn was planted. This is a bit ahead of the normal pace of 71 percent for that date. 53 percent of the soybeans were in the ground, compared to 38 usual for that date.

Traders know that earlier planting usually translates to higher yields, so that is holding markets down. However, this past weekend saw heavy rains in the heart of the Midwest, so the planting pace will slow this week.

Traders have also learned that “rain makes grain”. This was reinforced the past 2 years, as wet, late springs failed to dampen yields by very much. It will take sustained dryness to get a supply side rally going.

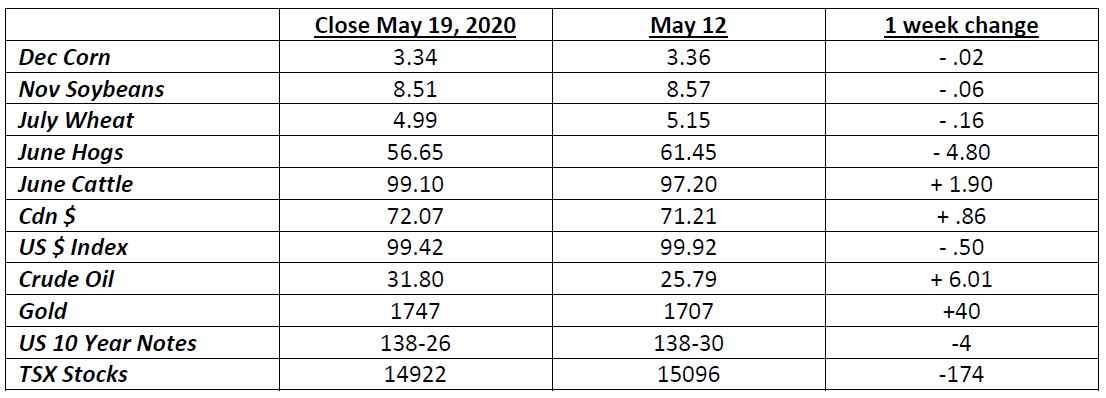

The demand side is showing some life lately. Crude oil is back over $30.00/barrel after the total collapse in late April. That is still very cheap, but at least the trend is in the right direction. Usage is increasing as economies begin to open up.

Ethanol production is picking up somewhat too and stocks are declining. USDA thinks they will use 250 mln bu more for ethanol for the 2020/21 crop than the amount for the current crop, which fell hard so far in 2020.

USDA also expects corn exports to be up 375 mln bu this year and feed use by 350 mln. compared to last year, so USDA is optimistic on demand. However, they predicted a record 15.995 bln bu crop, which would blow away the previous record in 2016.

It is likely, however, that production will not get that high. There is some switching going on from corn to soybeans because of the soy/corn ratio. Yield will be the main factor for price direction. The US hasn’t had a serious, widespread drought since 2012.

The Canadian dollar has been strong lately and is up 3.7 cents from its March low. This is negatively impacting basis. This is the last thing Ontario farmers need right now with Chicago prices as low as they are.

Trump today gave details on the $19 billion farm program, with $16 billion of that in direct payments to their farmers because of the low prices. It is very unfair that our government basically only gives lip service to our farmers, especially grain farmers.

Farm income in Ontario and Canada will take one it’s largest drops ever in 2020. The playing field is very unlevel with our American competitors. Farm groups are trying their best, but sadly it’s all falling on deaf ears.

This, despite the importance of agriculture to everyone and the economy. I suppose there’s just not enough votes in the farming community for the Liberal government to care.

Frank Backx.

|