|

Demand destruction dominated the headlines in ag markets again. The ethanol story has been well documented, as the crude oil collapse has caused ethanol production to be unprofitable.

The cheapest oil prices in decades came about as major suppliers produced too much and then demand tanked due to coronavirus. Everyone is driving less and airlines are operating at 10 percent of capacity.

Livestock prices are very weak as packing plants are on reduced kill, also because of Covid. One third of US hog slaughter is currently shut down. Wholesale cattle prices hit record highs, as retail supplies are being limited by the shutdowns.

More and more jurisdictions are easing up on the restrictions associated with the virus, which is a good thing. The economy has taken a major hit, but the fiscal and monetary stimulus governments are supplying will surely help.

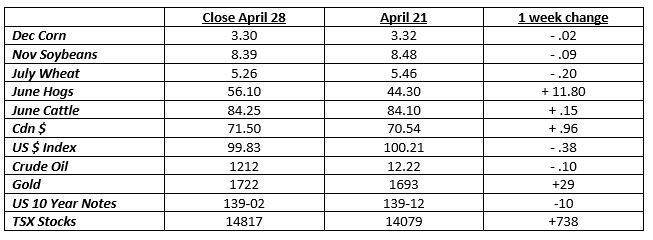

The TSX index in Toronto has gained back nearly 50 percent of the drop that started in February. The US S&P has recovered 60 percent of its losses, as energy isn’t as large a part of their index. Markets will now react to how well economies do after things open up.

Unfortunately, it’s the Mom and Pop shops that have borne the brunt of the shutdowns. This is especially true in rural Ontario. Meanwhile, Amazon and Netflix stocks recently hit record highs, as consumer habits have changed.

It will take months for the world to get back to where it was before Covid. Where people are allowed more freedom, the pace of progress is slow. Too much fear has been driven into society for a rapid recovery.

Another side affect of what’s going on is that there has been an increase in demand for edible beans, both soy and dry, especially from Asia. African Swine Fever caused higher meat prices, and corona is doing the same thing everywhere now.

Hensall Co op is trying to fill their new orders. Net returns can be greater than for the traditional crops, assuming average yields, and considering the cost of production.

Most of Hensall’s edible soybeans carry a premium of $3.25/bushel. With elevator soybeans currently at $11.10, the premium is nearly a 30 percent to crusher beans. Yield drag isn’t great and cost of production isn’t that different.

Compared to the $4.20 corn harvest price, kidney beans can return an extra $300.00 per acre. For those that would rather “direct harvest”, white and black beans can return an extra $135 to 150 per acre compared to corn.

Another advantage of dry beans is that it splits up the workload, as they can be planted in June, and harvested in September. Planting wheat earlier, after the bean harvest, usually leads to higher wheat yields also.

Frank Backx

|