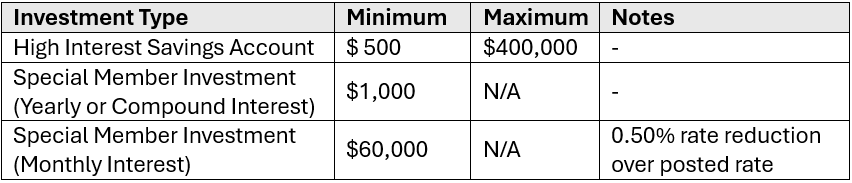

| Members have the opportunity to invest in Hensall Co-op in the form of an unsecured investment at interest rates that are typically higher than Guaranteed Investment Certificate (GIC) rates. Investment types include: |

High Interest Savings Account |

Similar to your typical savings account, interest is calculated on the daily account closing balance and paid monthly, at a rate determined by the Board of Directors. Funds can be deposited and withdrawn at any time. A monthly statement is provided showing all transactions throughout the month.

|

|

Special Member Investments |

At Hensall Co-op, we offer short term and long term investments ranging from 3 months to 10 years. Interest can be paid monthly, annually or compounded. For monthly interest, the minimum investment required is $60,000 and the interest rate is reduced by 0.50%. Special Member Investments have certificates issued which are signed by the President and Secretary of the Board of Directors. |

You can invest anytime in the comfort of your own home by sending funds electronically through your online banking or, by sending us a cheque or, visiting our office. For High interest Savings Account deposits, once we receive your funds you can view your balance using our convenient Customer Information System and a monthly statement will be sent to you by email. For Special Member Investments, a Debenture Application detailing the amount invested, term chosen, maturity date, interest rate and payment frequency will be sent to you for signature. This can all be done electronically from your home, office or on the go.

Online: add “Hensall District Co-operative” as a bill payee through your online banking and use your 6-digit Hensall Co-op Account Number. This will take 1-2 business days to reach Hensall Co-op.

Mail a cheque made payable to “Hensall Co-op” to 1 Davidson Drive, Hensall ON N0M 1X0.

Stop in to any location and make a payment by cheque or debit card.

A withdrawal from the High Interest Savings Account is very simple. You may call our office and request the funds. Upon request, we will send the funds to your bank account which will take 1-2 business days to reach you.

Interest can be paid:

Compounded: interest is calculated on an account's principal plus any accumulated interest earned and added to the investment balance annually

Annually on the anniversary date of the investment

On the first of each month with an interest rate reduction of 0.50% and minimum investment of $60,000

Log in to our online platform here to view your account details, balances and more. If you have not previously signed up to access the online platform, click 'Register Now'.

For High Interest Savings Account holders, you will receive a monthly statement showing the monthly transactions and new balance.

The interest rates are the same for any value of investment.

There are currently no service charges for any investment transactions.

No, our investment options are not eligible to be tax free or registered.

Similar to a savings account at any financial institution, the High Interest Savings Account interest rate may fluctuate without notice and effectively becomes your new interest rate.

Prior to maturity you will be contacted by our office to complete a Maturing Special Member Investments Direction to indicate what you would like done with your maturing investment.

Options include:

Reinvest full balance

Reinvest partial balance, withdraw partial balance

Withdraw full balance

If I reinvest, can I add additional funds to the reinvestment?

Yes, you may add additional funds to the investment.

Can I keep the same interest rate?

The interest rate would be based on the current rates at the time of maturity.

Investments cannot be withdrawn prior to maturity.

Log in to our online platform here to access your membership card. If you have not previously signed up to access the online platform, click 'Register Now'. The card is located under the “Membership Information” tab.

No, the membership fee is a one-time lifetime fee.

Please click here to sign up to receive email updates from Hensall Co-op.

To find out more about becoming a member or investing in Hensall Co-op as a Member-Owner, contact our Membership Services and Credit Manager Sylvie Atwell at 519-262-3511 ext 262, Toll Free: 1-800-265-5190 ext 262 or [email protected]