|

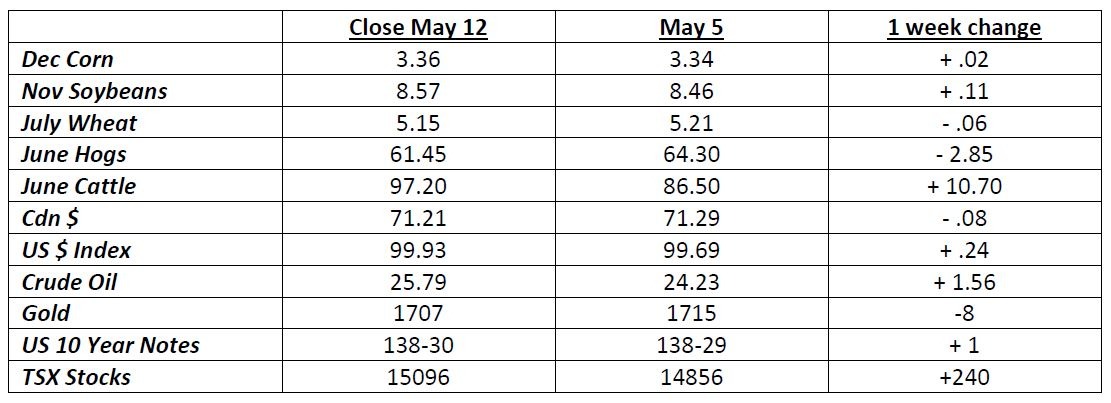

Grain prices were mixed over the past week, as they seem to have found an equilibrium. US weather will be the driving force over the next 4 or 5 months.

US farmers planted another 16 percent of their corn and 15 percent of their soybeans last week, to put them well ahead of last year and the average for the 10th of May. 67 and 38 percent of those crops are now in the ground.

USDA released its monthly demand/supply report on May 12. The May instalment always includes the first estimates for new crop, as well as updating the old crop.

US old crop corn carryout (CO) was put at 2.1 bln bu, less than the 2.22 expected. The CO for the 2020/21 crop was put at 3.389 bln, or 61 percent more. This would be the highest since 1988.

Old crop soybeans were pegged at 488 mln bu., less than the 580 expected. The new crop is expected to decline to 430 mln, for a 13 percent decline.

US wheat numbers were in line with expectations. The CO will fall to 909 mln bu, compared to 978 for last year. This would be the lowest since 2014. US wheat is rated 53 percent good/excellent.

World corn and wheat CO’s were well above expectations, while soybeans were less, as USDA expects China to import 7.2 mln mt more what they bought the past year.

Overall, there were no major surprises, so prices didn’t react much. Most traders are aware that USDA is notoriously high in these early estimates. Acres and yield will, as always, change these numbers.

It appears to me that grain prices are near wrung out on the downside. Prices are at long term support on the charts and near their lowest levels in over a decade.

Meanwhile, farmer’s cost of production has increased markedly over the past 10 years. Higher yields have contributed to this divergence, and this is a testament to how efficient farmers have become.

Outside markets were quiet also, with more gainers than losers. Most countries are being cautious about opening up their economies too quickly. Hopefully all the sacrifices will have been worth it and the world will get back closer to where it was.

Frank Backx

|