|

|

|

Membership in Hensall Co-operative is open to individuals, partnerships or corporations engaged in agricultural business on a full or part-time basis with $15,000.00 minimum annual business of products/services from or to Hensall Co-op and their immediate family.

(‘Immediate family’ members are spouse, parent, grandparent, brother, sister, child or grandchild of individuals or partners or shareholders, such family member must be involved in the agricultural business with the prospective member.)

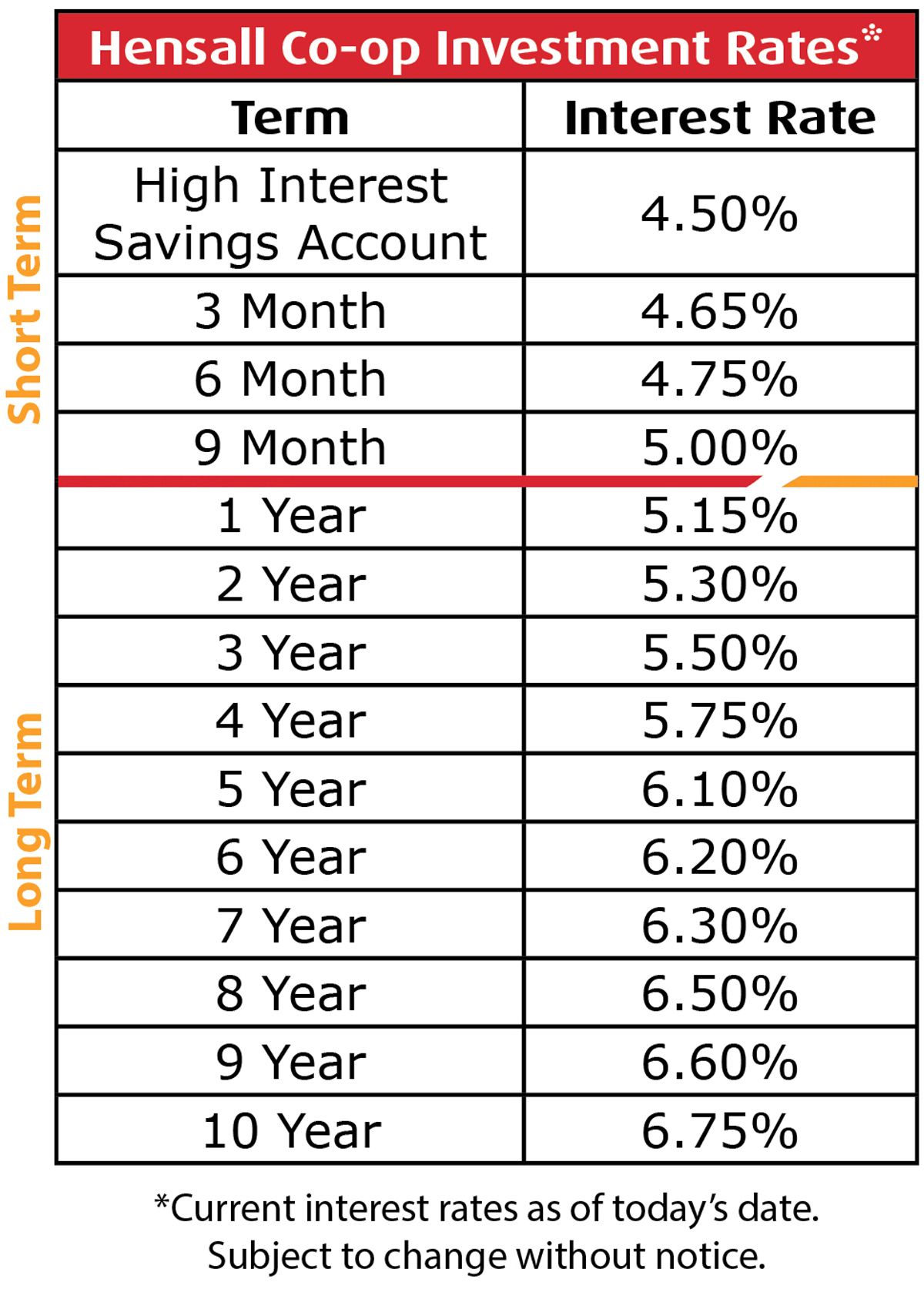

Short Term Demand Investment |

The maximum amount to be invested by an individual member is $400,000. These investments are "unsecured". Interest is calculated monthly, taking into account daily all new investments and repayments during the month, at a rate determined by the Board of Directors. Interest is paid monthly by crediting the Short Term Demand Member Investment balance. A monthly statement is sent to the member showing previous monthly balance, plus additional funds invested, plus interest added, less any amount of the investment repaid.

|

|

Special Member Investments |

At Hensall Co-op, Long Term Member Investments are called "Special Member Investments" which are issued for one, two, three, four, five, six, seven, eight, nine or ten years and are "unsecured". They are not a requirement for membership. Interest rates are usually higher than Guaranteed Investment Certificate rates. Interest can be paid monthly, annually or compounded. For monthly interest, the minimum investment required is $60,000 and the interest rate is reduced by 0.50%. Special Member Investments have certificates issued which are signed by the President and Secretary of the Board of Directors.

a) Patronage Dividend Investments

The Patronage Dividend Investment occurs from:

Members must first have $500 in the Mandatory Member Investment before repayment of 10% of the declining Patronage Dividend balance occurs.

After the first $500 Mandatory Member Investment is satisfied, one half of the 10% Patronage Dividend repayment is transferred to the member's Mandatory Member Investment and the other half is paid in cash on each December 1st, permitted the repayment is greater than $250. If the repayment is less than $250, the full 10% is transferred to the Mandatory Member Investment.

The 10% repayment policy is in effect at the present time, but can be changed by resolution of the Board. No interest is paid on Patronage Dividends that have not been repaid.

b) Mandatory Member Investments Funds transferred from Patronage Dividends are usually obtained from the transfer of patronage declared in the manner described in the previous section. It may also be paid in cash voluntarily by the member up to $500. Annual interest rate is 5% and interest is paid yearly on December 1st. Interest payments under $50 are added to the balance of the account instead of being paid in cash to the member. However, if the Co-op has a profitable year, directors can, at their discretion, pay a bonus over the 5% minimum interest rate. As an example, directors have authorized a 3.0% bonus over the 5% rate following the 2021 fiscal year. These investments are "unsecured". No maturity date is given on the Mandatory Member Investment. Upon death, the member's estate can request a repayment of this investment. Also, if the member sells his farm assets, or moves from the area, the member can request a repayment of the investment.

No certificates are issued for these amounts; however, each year on December 1st, a detailed report is prepared for the member showing last year's balance of the Mandatory Investment, plus transfers of Patronage Dividends or Voluntary Additions to the Mandatory Investment. |